AI Agents in BFSI: Transforming Debt Collection with Smart Automation and Human Sensitivity

Debt collection has historically been a challenging process, balancing the need to recover funds while preserving customer relationships. Traditional methods, such as manual follow-ups, rigid reminder systems, and legal escalations, have often proven inefficient, costly, and damaging to customer trust.

With the rise of AI-driven solutions, the debt collection process is undergoing a transformation. AI agents now enhance customer interactions, improve recovery rates, and optimize operational efficiency—all while ensuring financial institutions adhere to regulatory requirements.

This article explores how AI agents are reshaping debt collection, detailing key use cases, a deep dive into AI-powered payment negotiations, and the essential components required for an enterprise-ready AI debt collection system.

A. Key Use Cases for AI Agents in Debt Collection

AI-powered debt collection solutions provide automation, data-driven insights, and real-time customer engagement, solving critical challenges for financial institutions. Some of the top use cases include:

Personalized Payment Reminders

Instead of generic reminders that are often ignored, AI agents personalize outreach based on customer history, tone analysis, and behavior. These reminders are intelligently timed and sent via SMS, email, WhatsApp, or automated voice calls, significantly increasing engagement.

Smart Payment Plan Recommendations

When customers struggle with payments, AI-driven systems assess financial constraints and offer tailored repayment plans. By analyzing past transactions, financial obligations, and repayment trends, AI ensures that the proposed plans are manageable and encourage compliance.

Early Detection of Financial Hardship

AI agents monitor customer sentiment, repayment behavior, and account activity to identify early warning signs of financial distress. This allows financial institutions to proactively offer support programs or adjust collection strategies to accommodate the customer’s situation.

Compliance-First Collections

AI ensures adherence to financial regulations, automatically documenting interactions, detecting risky behavior, and flagging cases that require human intervention. This minimizes legal risks while ensuring ethical collections.

AI-Driven Collection Strategy Optimization

Machine learning models enhance decision-making by prioritizing high-risk cases and predicting the likelihood of repayment, allowing institutions to allocate resources more efficiently.

B. AI Agents Example for Automating Payment Plan Negotiations

How AI Agents Handle Payment Negotiation Using Observe-Reason-Plan-Act

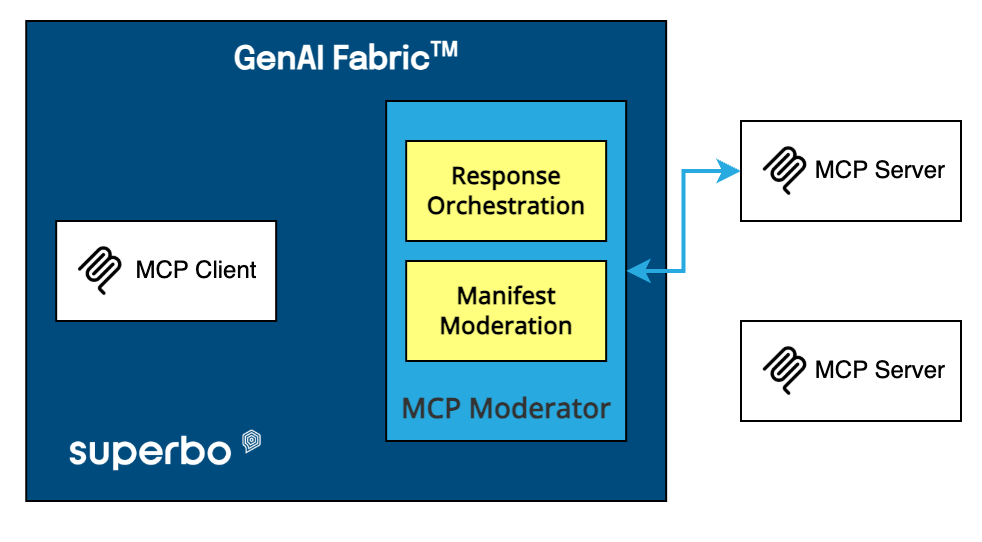

To illustrate how AI-driven debt collection works, let’s examine how a Payment Negotiation Agent within Superbo’s GenAI Fabric automates customized repayment plans for a delinquent customer.

Observe

• The Risk Assessment Agent monitors customer repayment patterns, sentiment analysis, and account activity in real time.

• It detects that the customer missed two consecutive payments and flags the case as medium risk.

• The Customer Engagement Agent initiates a conversation through the customer’s preferred channel (Viber, WhatsApp, Messenger etc.)

• The customer responds: “I can’t make my full payment this month. What can I do?”

Reason

• The Payment Negotiation Agent retrieves data from:

1. The Risk Assessment Agent (to determine past payment behavior and likelihood of repayment).

2. ML-powered forecasting models (to predict the most effective payment plan based on income trends and prior customer responses).

3. The Compliance Agent (to ensure any offer aligns with financial regulations).

• The Negotiation Agent determines:

1. Is this a short-term issue? → Offer a grace period.

2. Is this a long-term financial strain? → Offer a structured installment plan.

Plan

• Based on the data-driven assessment, the Negotiation Agent generates personalized repayment options:

1. A grace period with no penalty (for short-term financial issues).

2. A structured installment plan over three months (for moderate hardship).

3. A hardship program referral if the customer meets eligibility criteria.

• The Customer Engagement Agent presents these options conversationally:

"We understand your situation. Would you like a one-month extension or to break the balance into three smaller payments?"

• If the Negotiation Agent detects hesitation, it triggers the Human-Handoff Agent to escalate the case to a live representative.

Act

• The Customer Engagement Agent confirms the customer’s choice and executes the agreed-upon plan.

• The Risk Assessment Agent updates the customer's profile, ensuring future interactions reflect the new payment arrangement.

• The Compliance Agent logs the interaction for regulatory auditing, ensuring all terms align with consumer protection laws.

• The Customer Engagement Agent sends a follow-up confirmation via email or SMS with payment reminders.

Outcome

• Customer receives a manageable, data-driven repayment plan.

• AI agents ensure compliance and optimize recovery rates.

• Minimal human intervention is required, saving operational costs.

C. Blending AI Efficiency with Human Sensitivity

Debt collection is a highly sensitive process. While automation improves efficiency, a humanized approach is critical to maintaining customer trust. AI agents blend automation with emotional intelligence, ensuring collections are handled with compassion and compliance.

Personalized Customer Engagement

AI agents adapt communication tone and payment plans based on individual financial situations.

Empathy Detection and Vulnerability Support

AI-powered sentiment analysis detects frustration, stress, or financial distress and escalates sensitive cases to human agents or financial counseling services.

Seamless Human Handover

For complex cases, AI agents transfer conversations to human agents with full context, ensuring smooth customer interactions.

D. The Essential Components of an Agentic AI Debt Collection Solution

Many vendors claim to offer AI-driven debt collection, but their approach is often just fine-tuning an LLM with pre-written prompts. While LLMs can handle basic conversational interactions, they lack the decision-making capabilities needed for effective debt recovery.

An enterprise-grade solution requires:

Here’s why and what the role of each component in this solution is:

Why Machine Learning Models Are Essential

An effective AI-powered debt collection system must go beyond simple question-answer interactions and take proactive, strategic actions. Machine Learning (ML) models provide the intelligence layer needed for this.

Key ML Capabilities That Power AI-Driven Debt Collection

Predicting Default Risk & Repayment Probability

ML models analyze historical payments, spending behavior, employment data, and external financial factors to predict who is most likely to default and who can be rehabilitated with the right strategy. Instead of relying on rigid rule-based escalation, ML allows AI agents to:

- Prioritize high-risk customers for immediate intervention.

- Identify customers who need financial restructuring before they miss payments.

Customer Segmentation for Personalized Outreach

- Payment history (Consistent payer, occasional late payer, chronic defaulter).

- Financial health indicators (Income stability, spending trends, economic shocks).

- Communication responsiveness (Active in chats, ignores reminders, frequently requests extensions).

Dynamic Payment Plan Optimization

ML models determine which repayment plans are most likely to be accepted and completed based on:

- Past successful negotiations for similar profiles.

- Behavioral indicators of willingness to repay.

- Current market and inflation data affecting affordability.

This allows AI agents to dynamically adjust repayment structures to maximize compliance and recovery rates.

Automated Fraud & Anomaly Detection

ML-powered fraud detection identifies irregular payments, account takeovers, and synthetic identity fraud—helping financial institutions prevent unauthorized transactions and securely manage debt recovery.

Context-Aware Conversational AI

ML models ensure that AI-driven responses are:

- Accurate (fact-based, using verified financial data).

- Personalized (tailored to customer-specific financial profiles).

- Legally compliant (ensuring responses align with BFSI regulations).

By integrating ML-driven intelligence into AI agents, the system adapts dynamically instead of relying on static LLM fine-tuning.

Why an Agentic Approach is Necessary

A truly autonomous AI-driven collection system requires more than just answering customer queries. It must:

Different AI agents should work together within an agentic workflow to automate the entire collection lifecycle.

Types of AI Agents Needed for a Debt Collection Solution

A modular Agentic AI-driven collection system consists of multiple specialized agents, each responsible for a distinct function. If these agents need to be supported by specialized ML models, these are explicitly described:

Risk Assessment Agent (Predictive & ML-Driven)

- Function: Analyzes customer financial history, spending behavior, and risk indicators to classify debtors into priority groups.

- ML Model Support: Uses predictive analytics to determine default probability.

- Agentic Workflow Role: Provides real-time risk scoring, influencing how other agents engage with customers.

Customer Engagement Agent (Conversational & Adaptive)

- Function: Manages personalized customer interactions across SMS, WhatsApp, voice, and web chat.

- ML Model Support: Uses sentiment analysis and behavioral analytics to adjust tone, urgency, and message type.

- Agentic Workflow Role: Determines how and when to engage customers based on Risk Assessment Agent insights.

Payment Negotiation Agent (Autonomous & Adaptive)

- Function: Dynamically suggests and negotiates tailored payment plans based on customer affordability.

- ML Model Support: Predicts which repayment plans are most likely to be accepted and completed.

- Agentic Workflow Role: Coordinates negotiations, plan adjustments, and customer approvals, ensuring higher recovery rates.

Compliance & Regulatory Agent (Security & Oversight)

- Function: Ensures collections remain compliant with financial regulations, consumer protection laws, and data privacy standards (e.g., GDPR, CFPB).

- ML Model Support: Detects compliance risks, improper handling of customer interactions, and unauthorized data access.

- Agentic Workflow Role: Prevents non-compliant AI actions, ensuring all interactions adhere to legal and ethical standards.

Escalation & Human-Handoff Agent (Seamless AI-Human Collaboration)

- Function: Detects cases that require human intervention, ensuring a smooth transition from AI to human representatives.

- ML Model Support: Uses anomaly detection and case complexity scoring to decide when human involvement is necessary.

- Agentic Workflow Role: Automates case escalations, passing full interaction history to human agents, preserving context and compliance.

Why an Agentic Framework is Critical for Security & Compliance

A secure and regulated debt collection solution must adhere to data protection laws, fraud prevention policies, and ethical debt recovery practices. An agentic framework ensures that AI agents operate within strict compliance guidelines while maintaining customer trust.

Privileged Access & Secure Transactions

AI agents only retrieve and process customer data based on role-based access control (RBAC), ensuring compliance with financial industry regulations

PII (Personally Identifiable Information) Protection

All AI-driven transactions must handle PII securely, enforcing end-to-end encryption, anonymization, and controlled data exposure

Auditability & Regulatory Compliance

An agentic system logs all interactions, decisions, and escalations, ensuring full auditability for financial regulators

Ethical Debt Collection

By integrating hardship detection models, AI ensures that collections remain ethical, personalized, and humanized, preventing aggressive collection tactics that violate industry regulations

Conclusion

When in the quest for selecting a true Agentic AI solution for your BFSI, be very careful with the key solution/component vendors promote. A real solution requires:

Superbo’s GenAI Fabric Agentic Framework is built to handle the complexity of modern debt collection, integrating:

By leveraging agentic AI workflows, financial institutions can boost recovery rates, reduce operational costs, and maintain a fair, transparent, and efficient debt collection process.